8 mistakes on the road to wealth

You must understand that money not only never sleeps – they know neither fatigue nor holidays. Money requires attention and is always attracted to those and committed to someone who has dedicated himself to them and respects them.

You must understand that money not only never sleeps – they know neither fatigue nor holidays. Money requires attention and is always attracted to those and committed to someone who has dedicated himself to them and respects them.

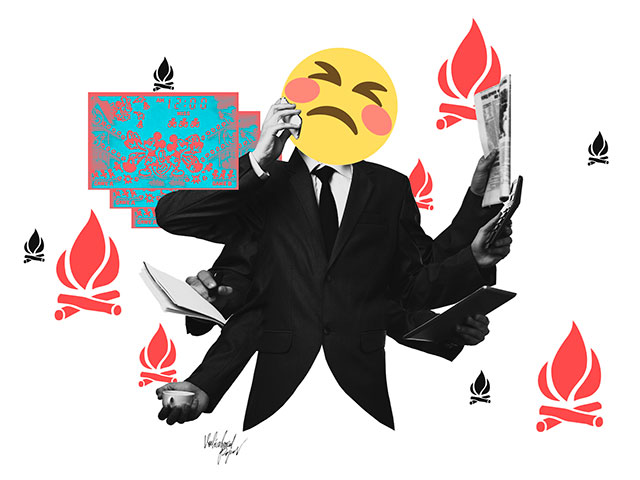

Although most people say they want more money and want to achieve financial success, most people never really reach it. Why? The reason is simple. We make mistakes in handling money.

I bet that you, like me, made some of these errors:

1. Calmed down, stopped striving.

Satisfaction is one of the most dangerous elements in finance. The idea of a middle class is based on convenience, contentment, on earning only as much as you need. Wealth is never enough wealth, and they never calm down. They seek freedom and abundance and always strive for more.

2. Diversification.

Walstreet did an excellent job selling people the idea of diversification, so Walstret benefits from it. As my friend Mark Kyuban says, “diversification is for idiots.” If you want to create wealth, you need to know when to rake everything into one place. Find one way and bet on it. Andrew Carnegie said: “The way to get rich is to put everything on one card and follow this card.”

3. Depend on a single source of income.

No matter how great this one source is, one can never depend on one source of income. In 2008, I was familiar with a woman administrator who earned $ 350,000 a year (she was among the highest paid 1%) and suddenly her source of income stopped. Create multiple streams of income that will be poured into a bucket with your wealth. This is not the diversification of wealth – it is its strengthening.

4. Compare yourself with “Ivanovs.”

76 percent of working Americans live from paycheck to paycheck. I think that statistics are similar in other countries of the world. Compare yourself with most Americans (or your compatriots), and it will seem to you that you are doing well. Never compare your finances with others. It is said that beauty is in the eye of the beholder, but money is not in the “eye of the beholder.” You either have enough money – or not.

5. To be seduced by the most fashionable new things.

Avoid investing in any company that may be superseded by the advent of new technologies. Did you have a Blackberry phone? Is there still? I look at what people will always need and invest in the fact that new inventions will not be swept away.

6. Be naive and too trusting.

The most serious mistake in my life regarding finances was my naivety when I believed one group of people because I liked them. I did not bother to take the time to check that they are what they pretend to be. By the time I realized that something was wrong, I had already lost millions of dollars. Do not believe your feelings and look for reliable evidence.

7. Save for the sake of saving.

Saving, you can go bankrupt. Money that is “idle” will go to another place. Money gets boring, they need action, they have to work. To create wealth, you need to invest excess in what will create new opportunities that generate income.

8. Become a “mod” ahead of time.

The opposite of the miser is a spender who tries to impress others with his cars, clothes and watches. I bought my first luxury car only when I already had millions in store. When I finally started to buy luxury goods, it was already unimportant to me that these were unprofitable investments. It may seem that the very rich (real dandies) flaunt money, that they are wasteful. In fact, it is not. The watches on their hands belong to them, not the Visa credit card.

In custody:

It is your responsibility to create wealth for your family, for your business and for your dreams to come true. I would very much like to wish you the best of luck in avoiding mistakes in creating wealth; but just luck is not enough. Mistakes are inevitable. Learn from them and create true freedom for yourself!